We have all heard that measuring what matters is how successful businesses are run. As for what are often called “intangible assets,” that has long been a different conversation.

Research points to the inescapable conclusion that we are emphasizing measurement on what used to matter, whereas the focus and robust attention needs to shift to what matters in today’s world – environmental, social and governance (ESG) actions and impacts.

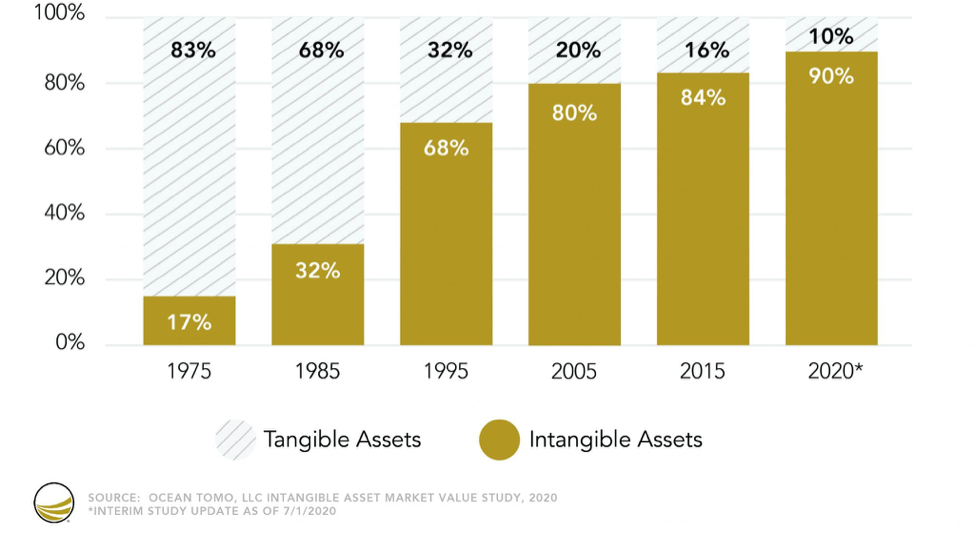

More than a decade ago, a shareholder activist and corporate governance adviser, Robert A. G. Monks, joined with Alexandria Reed Lajoux, founding principal of Capital Expert Services, LLC (CapEx), to quantify what went into defining what goes into corporate valuations. They determined that between 70 and 90 percent of the value of publicly traded companies in the U.S. was attributable not to the physical and financial assets, but was embedded in what many have described as intangible assets, which can include intellectual property, customer loyalty, employee engagement and productivity, labor relations, community goodwill, brand reputation and analysts’ perceptions.

In a recent study, the advisory firm Oceana Tomo updated this research, finding that the percentage of value associated with intangible assets is 90 for the S&P 500 and that the same trend can be seen - although not as starkly for the S&P Europe 350 index - with an increase from 71 percent in 2015 to 74 percent in 2020.

Why is this important? Because these things are best enhanced by the effective management of ESG efforts one can make the case that measuring and managing sustainability efforts impacts is increasingly the largest family of drivers of corporate value. Therefore, it is time that we stopped considering to the largest contributor to corporate value of a business as intangible assets. It’s time for holding companies to measure and report their ESG efforts and results with the same precision and subject those metrics to the same level of scrutiny and professionalism that we associate with more traditional metrics that are included in corporate balance sheets, financial reports and public filings.

The Governance & Accountability Institute, a New York-based sustainability consulting and research firm, has found that slightly less than a third (29 percent) of S&P 500 companies issuing sustainability reports included external assurance of their disclosures. It is likely that, just as the number of companies issuing reports has grown, so will the number that recognize the value and increased credibility to be gained by providing independently validated Sustainability disclosures.

And this is likely to grow, as skepticism around these reports remains high. Earlier this month, the examinations staff at the Securities and Exchange Commission (SEC) recently issued a risk alert to make investors aware of potentially misleading statements found during recent examinations of investment companies that offer ESG products and services.

While some countries, like France, have required social and environmental impact reporting of the company’s activities as well as their societal commitments for sustainable development into their annual reporting requirements, that is not the case everywhere. Where it is required, both ORÉE and KPMG found that the new legislation has helped improve the non-financial corporate communications.

As more and more investors and companies recognize that what has long been called intangible assets have very real and tangible impacts on corporate valuation, the continued trend toward professionalizing sustainability reporting is likely to increase in the future. And it is a safe bet that some proactive companies are already laying the foundation by creating internal mechanisms today for this eventual evolution of ESG reporting, whether it is compelled by the marketplace or laws.

After all, if you’re not validating the most impactful data relating to the true value of your company, how well are you really managing your business?

Image credit: Headway/Unsplash

John Friedman is an award-winning communications professional and recognized sustainability expert with more than 20 years of experience as both an external and internal sustainability leader, helping companies live their values and engage in authentic conversations by integrating their environmental, social, and economic aspirations into their cultures and business practices. He's the author of Managing Sustainability: First Steps to First Class.

John Friedman is Managing Director, ESG & Sustainability Services for Grant Thornton, LLP.

On digital media, Friedman is recognized as a thought leader; on TriplePundit’s List of the Top 30 Sustainability Bloggers on Twitter, #3 on GreenBiz list of most influential 'Twitterati', #14 on Guardian Business’ 30 most influential sustainability voices in America, was voted #4 of the "100 leading voices in CSR" by Global CEO Magazine readers, and has regularly been included among the top voices in CSR by Forbes.