A solar farm in the Dominican Republic. (Image: Aldward Castillo/Unsplash)

U.S. Energy Secretary Chris Wright attacked net-zero emission goals as “sinister” this week, but name-calling does not change the facts. Extreme weather events are happening more frequently as the global temperature rises, leading to a cascade of risks for businesses and investors. Regardless of Wright’s comments, business leaders are continuing to evolve new strategies in response to a real-world crisis.

Critics cite the high cost of decarbonization, but what about the costs of unchecked climate change?

The United Nations Race to Zero pledge calls for a substantial cut in global emissions by 2030 toward the goal of net zero by 2050. As of June, 107 countries and thousands of companies, cities, educational institutions, and financial institutions joined the program.

The U.N. warns that the pledgers have fallen far behind their commitments, but signs of accelerated activity are emerging. New technology solutions are beginning to scale up, and investors are beginning to take the value of nature into account. In 2024, clean energy accounted for more than 40 percent of global power generating capacity, and clean energy investments outpaced fossil energy investments by a wide margin.

That has put fossil energy stakeholders on edge, as indicated by the tone of Secretary Wright’s remarks on Monday. “Net Zero 2050 is a sinister goal. It's a terrible goal,” he said at a conference hosted by the conservative group Alliance for Responsible Citizenship in London, as reported by Reuters.

Before being appointed to lead the U.S. Energy Department, Wright was the CEO of Liberty Energy, which provides technology and services for oil and natural gas drilling. He took aim at the British government's net-zero targets in particular. "The aggressive pursuit of it ... has not delivered any benefits, but it's delivered tremendous costs," he said. He later described the goal as “lunacy” and asserted “the world simply runs on hydrocarbons."

Misgivings about the cost of decarbonization are easily refuted. For example, the fifth largest economy in the world, California, cut carbon emissions by 23 percent per capita between 2006 and 2022, while achieving a GDP increase of 38 percent per capita.

Be that as it may, risks related to extreme weather events are escalating in California and around the world. Financial institutions are now beginning to turn investor attention to the impacts of these events, rather than focusing narrowly on the familiar metric of average global temperatures.

'Climate intuition' series aims to build understanding of the risks ahead

Despite having joined other U.S. banks in leaving the Net Zero Alliance, JPMorgan Chase is among the firms raising the issue of climate risk in the context of hurricanes, floods, wildfires, droughts, heat waves and other weather-related extremes. The firm describes why climate risk is relevant in finance in a new report titled, “Navigating the New Climate Era: Building Intuition for Strategic Decision-Making.”

"Success in the new climate era hinges on our ability to integrate climate considerations into daily decision-making. Those who adapt will lead, while others risk falling behind," wrote Sarah Kannick, global head of climate advisory at JPMorgan and former chief scientist at NOAA, in the report.

The report is the first in a planned series aimed at cultivating a greater understanding of climate risk among financial firms, investors and policymakers. The series focuses on predicting the cost of climate change based on insurance markets, and exploring how new technologies and other adaptive strategies can enable stakeholders to manage present and future risks.

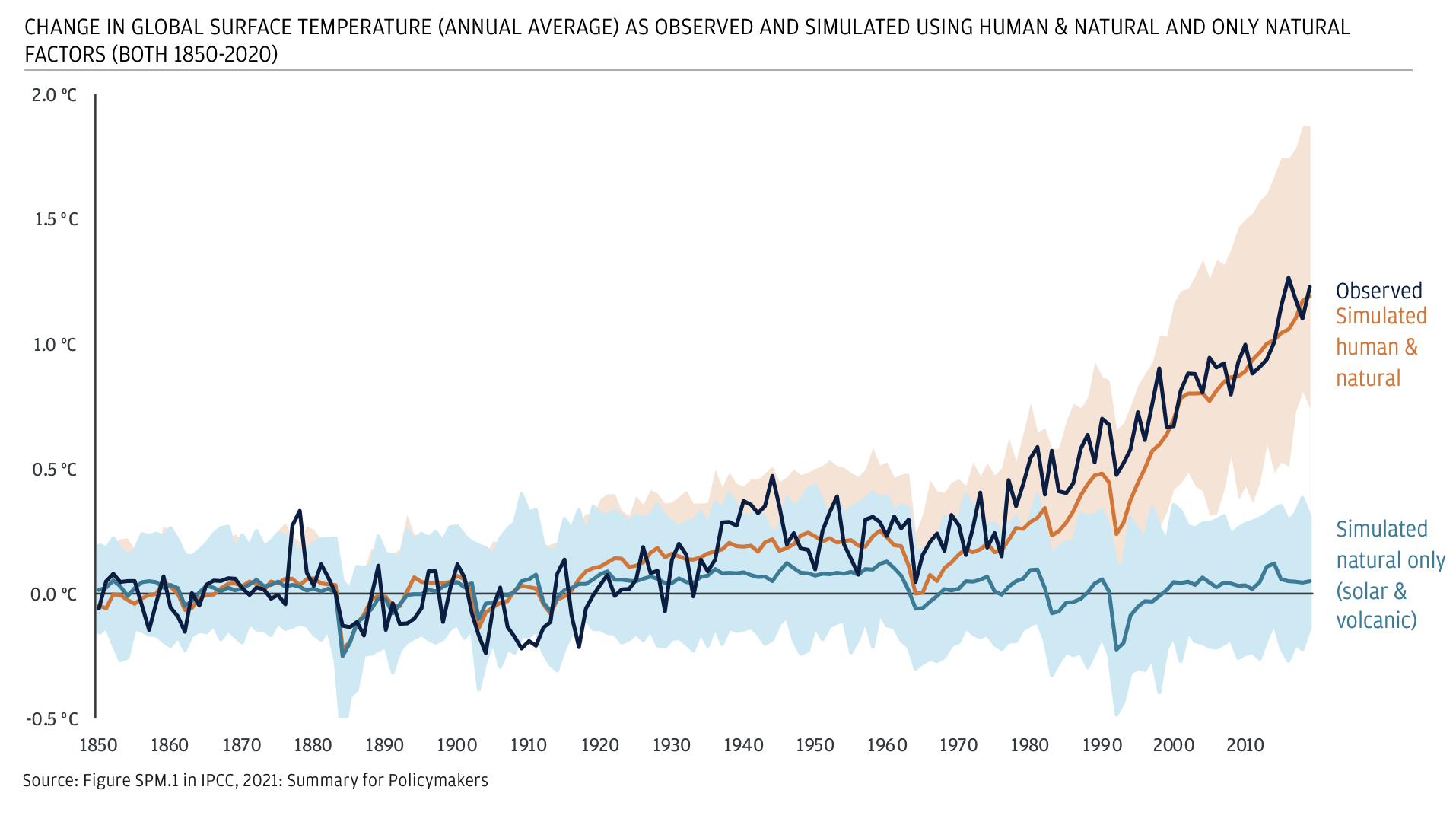

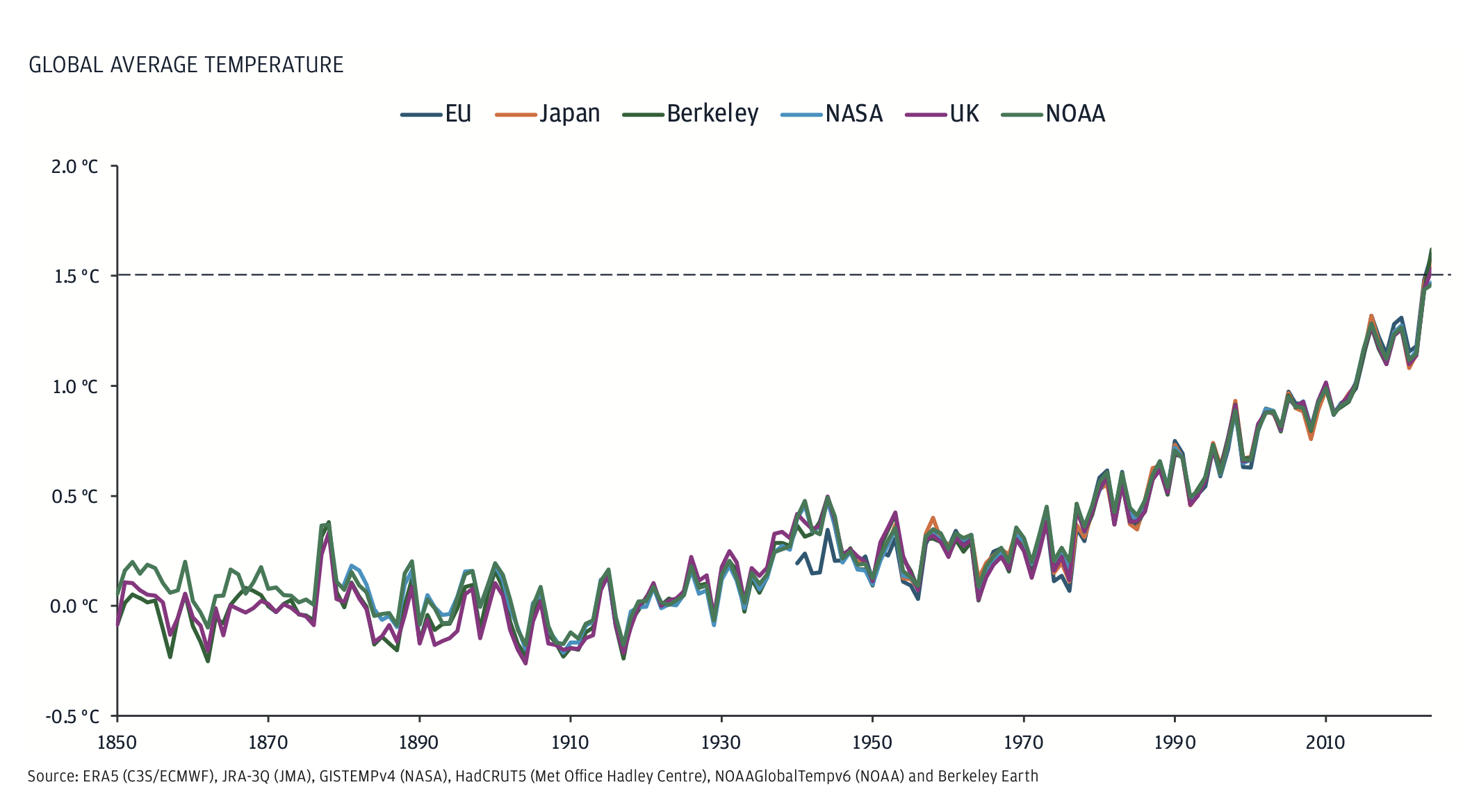

The first report serves as a primer, reviewing the conclusive evidence of global temperatures rising alongside human-caused emissions and the corresponding increase in extreme weather events.

"Climate change will increasingly manifest with each additional ton of carbon dioxide emitted," Kannick wrote. "Predicting the future using climate metrics requires quantifying how the climate changes and their interactions across society. This analysis can help identify a set of outcomes for how investments, technology, and policy will respond."

The majority of CFOs are already tracking climate risk

The majority of chief financial officers are already thinking ahead when it comes to climate risk, and many are now the key drivers of sustainable investing within their organizations, according to a survey released this week by the consulting firm Kearney.

"The perspective of CFOs is often overlooked in the corporate sustainability debate, yet their role is crucial. As those in control of financial levers, CFOs are uniquely positioned to have a long-term impact on business strategy,” Beth Bovis, a partner and global sustainability lead at the firm, said in a statement. “Beyond simply ensuring regulatory compliance, CFOs can lead the charge in driving investments that not only reduce emissions, but also deliver tangible commercial value for the business."

The survey, conducted with the climate action media platform We Don’t Have Time, included 500 CFOs in the U.K., U.S., United Arab Emirates and India. The results indicate that most CFOs recognize the long-term value of sustainability investments, with 92 percent anticipating their organizations will “significantly increase net investment in sustainability this year” and 93 percent recognizing the business case for sustainable investing.

In an indication that the climate intuition approach is already becoming widespread, 65 percent of chief financial officers said they're now measuring the cost of inaction. This signals “an increasing awareness of the long-term risks [posed] by climate change and regulatory penalties, as well as opportunities related to green transition,” Kearney concluded in a press announcement. “The findings suggest that CFOs are also recognizing the value of sustainable investments that both benefit the planet and resonate with values-driven investors and employees.”

Regardless of White House policy, the global financial community is equipping itself to move on from fossil fuels, reflecting a new reality of risks, consequences and opportunities. Though much of a CFO’s attention is focused on short-term profitability, 94 percent integrate sustainability into their investment decisions overall, Kearney's survey found.

Tina writes frequently for TriplePundit and other websites, with a focus on military, government and corporate sustainability, clean tech research and emerging energy technologies. She is a former Deputy Director of Public Affairs of the New York City Department of Environmental Protection, and author of books and articles on recycling and other conservation themes.