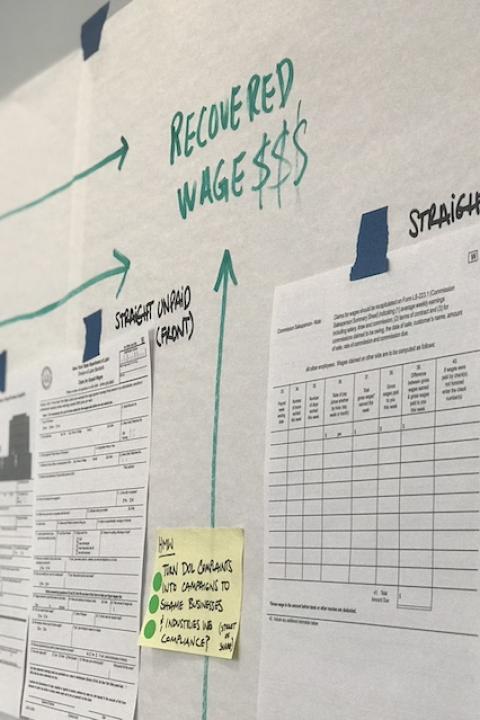

(Image courtesy of Village Capital)

This story is part of Closing the Gap, a guest-contributed column that boldly explores what's needed to achieve gender equity in education, business and society. If you're interested in contributing your perspective to this column, please get in touch with us here.

Women entrepreneurs often face an arduous journey in getting funding due to deep-rooted societal and cultural biases. In many markets, women entrepreneurs face significant challenges due to pervasive gender biases and stereotypes. These biases influence how they are perceived and treated by clients, investors and even their own families. Social norms also diminish women's networking opportunities, which are critical for business growth. Often, women are excluded from influential business circles, making it harder to get the essential mentorship and support they need.

Women are also expected to bear a disproportionate burden of family and household responsibilities. Striking a balance between these responsibilities and the demands of running a business can be an arduous task. This challenge is exacerbated in emerging markets, where women's access to education and business training is often limited, further constraining their entrepreneurial capabilities.

The hurdles don't end here. Women entrepreneurs frequently grapple with restrictive legal and regulatory frameworks that limit their ability to start businesses, own property or access credit. This is particularly pronounced in male-dominated industries, where women struggle to access new markets or compete effectively. When it comes to securing capital, the gender bias becomes even more pronounced. Women often face greater obstacles in obtaining funding from investors and banks due to gender biases, a lack of collateral, and the fact that property and other assets are often in the name of male relatives.

Exploring Village Capital’s holistic approach to empowering women entrepreneurs

At Village Capital, a global nonprofit organization at the forefront of early-stage impact investing and ecosystem building — which facilitates connections among entrepreneurs, investors, mentors, and other stakeholders to contribute to building a supportive and collaborative environment, enabling entrepreneurs to access resources for success — we’re actively working to distill and dismantle some of these challenges. Our strategy involves enhancing entrepreneurs' investment readiness through our acceleration programs while working to mitigate gender bias in investment decision-making.

To address the latter, we employ a peer due diligence and peer-selection methodology to guide our investments. Additionally, we recently introduced “Smarter Systems,” a toolkit outlining how to ensure investors do not overlook women-led startups by strengthening their due diligence processes, developed in partnership with Amisha Miller from New York University, Saurabh Lall from University of Glasgow, IFC, and We-Fi, in addition to a consortium of supporters.

The peer-selection methodology: transforming the entrepreneurial game

The principle of peer due diligence and selection disrupts the traditional dynamics of funding, and it is at the heart of Village Capital's ethos. In our investment-readiness acceleration and investment programs, it’s the entrepreneurs — not the investors — who hold the key to a pivotal decision: determining the recipients of investment.

The participant entrepreneurs use a consistent set of Venture Investment Levels to rank themselves and each other. These levels are integrated into the Milestone Planner tool, which is part of Village Capital's free online web app: Abaca. In this model, we act as facilitators, supporting their journey through investment-readiness training, mentorship, coaching, and fostering an overall collaborative spirit.

The peer-selected investment model is more than a process. It's a transformative shift in the power dynamics between the entrepreneurs and the investors. Gone are the days when the decision-makers, often detached from the grassroots realities of the problems they aim to address, dictate the flow of capital. In this reimagined landscape, the entrepreneurs hold the reins, armed with insights and a deep understanding of their sectors.

At Village Capital, using peer due diligence and selection began as a radical experiment that has since evolved into the foundation of our work. More importantly, it has proven to enable a more unbiased evaluation of investability and uncover the value of peer learning and due diligence.

The peer due diligence and selection methodology raises crucial questions: Can entrepreneurs accurately evaluate the future commercial success of their peers? Perhaps more significantly, does peer selection serve as a mitigating force against gender bias in evaluations?

The short answer is yes!

In a research study conducted in partnership with the Global Accelerator Learning Initiative, we found that the rankings startups received from their peers reflected, on average, their subsequent success in raising capital. Companies being ranked in line with their performance raising capital post-program suggests that evaluations are made based on the merits of a company, resulting in a less biased investment process. This also holds true regardless of the proportion of men and women in the cohort.

To date, close to 50 percent of the 110 startups that have been peer-selected for an investment, typically ranging between $25,000 to $100,000, are women-led companies. This stands in stark contrast to the industry, where women-led startups represent only 15 percent of the average portfolio.

A separate research initiative also found that startups who participate in Village Capital’s peer selection programs raise, on average, six times more capital than those who participate in any accelerator program, and almost three times more capital than those in a control group.

Smarter Systems: bridging the financing gap

While peer due diligence proposes a radical new way to allocate investments, our Smarter Systems toolkit seeks to provide practical, innovative ways to mitigate gender bias within traditional due diligence processes.

The framework aims to address two crucial questions: What does the gender financing gap look like for startups before and after investment-readiness acceleration programs? And what can investors and accelerators do to bridge this gap?

Male-led startups often secure significantly more capital post-acceleration than their female counterparts, according to a research study involving over 2,000 startups conducted in partnership with Village Capital.

Surprisingly, the gap could not be explained by any specific characteristics of the accelerator programs or by the distinct aspects of the startups, such as the founder's experience or education, a common misconception in the startup ecosystem. This suggested that the gender financing gap could partly be due to the discrepancies in startup evaluations stemming from investors' gender bias.

To address this, we collaborated with our academic research partners to test if and how making three tweaks to how investors evaluate startups could mitigate gender-based discrepancies:

1. Balanced assessment of risks and opportunities: We started by prompting investors to ensure they had a comprehensive understanding of each startup's risks and growth opportunities. We did this by simply adding a question for the investor to pause and assess the information they had collected thus far, and any remaining questions they still had on either topic. This approach sought to prevent investors from overly focusing on the growth opportunities of male-led startups and the risks of female-led startups.

2. Data-driven evaluation of founding team's potential: The second tweak had investors assess the founding team’s potential by evaluating their demonstrated ability to identify and execute improvements to their company strategy. This data-driven approach replaces gut instincts with factual assessment, leveling the playing field for all.

3. Predefined evaluation criteria: Lastly, we asked investors to predefine and assign weights to their evaluation criteria, and review this before evaluating startups. This ensures consistency in evaluations and prevents investors from adjusting their criteria to justify overlooking a promising startup.

The results were unequivocal. Implementing these steps led to more equitable, consistent and comprehensive assessments. Scores for women-led startups were five times higher in the treatment group compared to the control group.

Evaluation processes also have an impact on those being evaluated beyond funding outcomes. In the experiment, women on gender-diverse founding teams in the treatment group presented their startups to investors more often (instead of being replaced by a male co-founder) after experiencing more equitable evaluation.

The opposite happened in the control group, where women co-founders were more likely to take a step back and allow male colleagues to lead future presentations. This finding suggests that equitable evaluations are also essential due to their impact on moving ventures further along in investor pipelines and their effect on how often women engage in the startup ecosystem.

All together, these findings underscore a pressing need for systemic innovation in investment evaluation. Traditional methods often fail to recognize the potential in women-led startups, inadvertently favoring male-led ventures. Small adjustments like the above ensure fairer evaluations and open more opportunities for women entrepreneurs, ultimately benefiting the entire startup ecosystem. It's a testament to our belief that when women entrepreneurs thrive, the entire startup ecosystem flourishes.

Navigating complexity together: A call for collaboration

The journey of women entrepreneurs in securing capital is a complex one. While Village Capital has taken measures to address these issues, it's clear that more work is needed. A collaborative approach involving the collective efforts of entrepreneurs, investors, and industry stakeholders is essential. The road to achieving true equity in entrepreneurial opportunities is long and requires continuous, concerted, and connected efforts.

Village Capital’s commitment to this journey is unwavering and we welcome others to contribute to and reinforce this shift in mindset. I encourage you to reach out to me with any additional insights. Together, let's inspire and empower others to join us in building an equitable, supportive, and comprehensive environment where women entrepreneurs can truly thrive.

As Chief Growth Officer at Village Capital, Reem leads organizational revenue and demand generation, shapes mission-related messaging and storytelling, and oversees the management of our strategic plan, all focused on growing Village Capital’s capacity and financial wherewithal to widen and deepen its global impact and achieve its mission. Prior to joining Village Capital, Reem was the Managing Director of Endeavor Jordan, where she engaged rigorously with high-impact entrepreneurs, business leaders, disruptors, and investors from 40+ markets around the world, giving her solid exposure to global best practices on how to scale ventures, access capital, and expand into new markets. Prior to that, she was the Senior Manager and Lead Economist at Al Jidara, a regional consulting firm in MENA that provides economic, development, and management consulting services. She also spearheaded the establishment of several research and reporting units, as well as worked as a policy advisor for the Minister of Planning and International Cooperation in Jordan.