(Image: Tech Daily/Unsplash)

We all know changing financial providers can be a hassle. But more and more Americans are braving the paperwork and dreaded time on hold with customer service to move from one bank, insurer or pension provider to another. One of the reasons why might surprise you. While cost and returns remain key, for a growing cohort of consumers there’s a new reason to switch brands: sustainability.

More than half of U.S. consumers think it’s “important” or “very important” for financial service providers to act responsibly when it comes to society and the environment. And they're voting with their wallets. Banks, general insurers and pension providers lost $17 billion in 2023 as consumers switched to industry competitors they perceived as more sustainable.

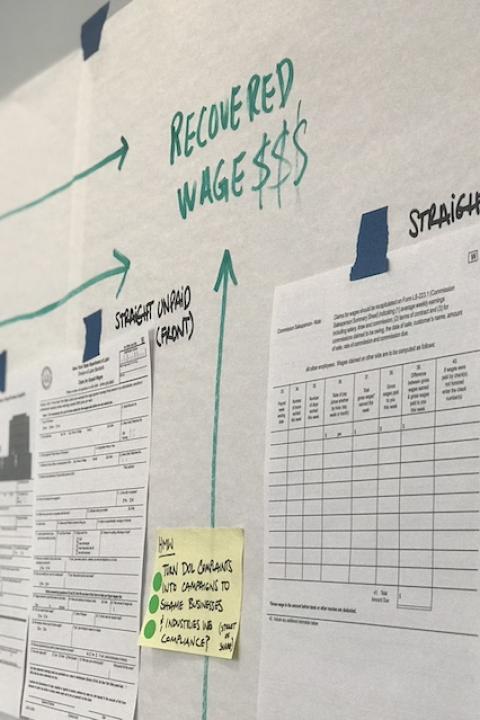

That’s according to an upcoming report from the research technology company Glow, in collaboration with TriplePundit, our parent company 3BL and panel partner Cint, that asked more than 3,000 U.S. consumers how sustainability impacted their purchase decisions across 12 industries. Glow combined the survey findings with other data and previous analyses to put a monetary value on the cost of consumers switching brands for sustainability reasons.

"Sustainability programs are often seen as discretionary, making it difficult for executive teams to commercially justify the ongoing investment when the economic backdrop becomes more challenging," said Tim Clover, CEO of Glow. "This report uses robust data to highlight the risks and opportunities of sustainability when consumer switching is taken into consideration."

More than 15 percent of survey respondents said they switched their bank, pension or insurance provider over the past 12 months because of their social or environmental behavior.

In each of these sectors, a third or more respondents said social and environmental considerations were either "a significant influence" or "the single most important reason" for choosing at least some of the financial services they use.

And that's only the start: Over half of consumers expect sustainability and social responsibility to have more impact on their choice of financial providers next year than they do today.

“Consumers are increasingly factoring social and environmental considerations into their purchase decisions," said Mike Johnston, managing director of data products at Glow. "This report highlights the cohorts that care and identifies the barriers preventing more consumers from choosing sustainable brands. It will help leading brands justify their efforts and those less developed identify areas of opportunity."

So, what’s motivating consumers to seek out other brands, how do they determine which brands are sustainable, and what type of sustainability messaging resonates most with them? We'll take a closer look in the Size of Prize Report, set to publish in January 2024. Click here to be updated when it's released.

Mary has reported on sustainability and social impact for over a decade and now serves as executive editor of TriplePundit. She is also the general manager of TriplePundit's Brand Studio, which has worked with dozens of organizations on sustainability storytelling, and VP of content for TriplePundit's parent company 3BL.